Even though predicting future cash flows is the primary goal of many users of financial

reporting, the model best able to achieve that goal is the accrual accounting model. A

competing model is cash basis accounting . Each model produces a periodic measure of

performance that could be used by investors and creditors for predicting future cash flows

CASH BASIS ACCOUNTING.

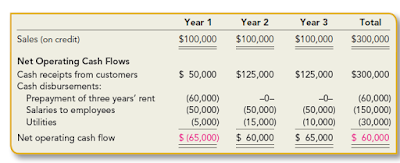

Cash basis accounting produces a measure called net operating cash flow . This measure is the difference between cash receipts and cash payments from transactions related to providing goods and services to customers during a reporting period. Over the life of a company, net operating cash flow definitely is the variable of concern. However, over short periods of time, operating cash flows may not be indicative of the company’s long-run cash-generating ability. Sometimes a company pays or receives cash in one period that relates to performance in multiple periods.

For example, in one period a company receives cash that relates to prior period sales, or makes advance payments for costs related to future periods. Therefore, net operating cash flow may not be a good predictor of long-run cash-generating ability. To see this more clearly, consider Carter Company’s net operating cash flows during its first three years of . Over this three-year period Carter generated a positive net operating cash flow of $60,000. At the end of the three-year period, Carter has no outstanding debts. Because total sales and cash receipts over the three-year period were each $300,000, nothing is owed to Carter by customers. Also, there are no uncompleted transactions at the end of the three-year period. In that sense, we can view this three-year period as a micro version of the entire life of a company.

|

| Illustration 1-2 |

ACCRUAL ACCOUNTING.

If we measure Carter’s activities by the accrual accounting model, we get a more accurate prediction of future operating cash flows and a more reasonable portrayal of the periodic operating performance of the company. The accrual accounting model doesn’t focus only on cash flows. Instead, it also reflects other resources provided and consumed by operations during a period. The accrual accounting model’s measure of resources provided by business operations is called revenues, and the measure of resources sacrificed to earn revenues is called expenses. The difference between revenuesand expenses is net income, or net loss if expenses are greater than revenues. 7

.

Revenue for year 1 is the $100,000 sales. Given that sales eventually are collected in cash, the year 1 revenue of $100,000 is a better measure of the inflow of resources from company operations than is the $50,000 cash collected from customers. Also, net income of $20,000 for year 1 appears to be a reasonable predictor of the company’s cash-generating ability, as total net operating cash flow for the three-year period is a positive $60,000 . Comparing the three-year pattern of net operating cash flows in Illustration 1–2 to the three-year

|

| Illustration 1-3 |

No comments:

Post a Comment