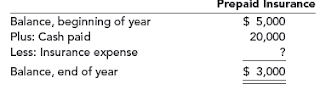

Adjusting entries, for the most part, are conversions from cash basis to accrual basis. Prepayments and accruals occur when cash flow precedes or follows expense or revenue recognition. Accountants sometimes are called upon to convert cash basis financial statements to accrual basis financial statements, particularly for small businesses. You now have all of the tools you need to make this conversion. For example, if a company paid $20,000 cash for insurance during the fiscal year and you determine that there was $5,000 in prepaid insurance at the beginning of the year and $3,000 at the end of the year, then you can determine (accrual basis) insurance expense for the year. Prepaid insurance decreased by $2,000 during the year, so insurance expense must be $22,000 ($20,000 in cash paid plus the decrease in prepaid insurance). You can visualize as follows:

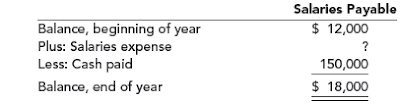

Insurance expense of $22,000 completes the explanation of the change in the balance of prepaid insurance. Prepaid insurance of $3,000 is reported as an asset in an accrual basis balance sheet. Suppose a company paid $150,000 for salaries to employees during the year and you determine that there were $12,000 and $18,000 in salaries payable at the beginning and end of the year, respectively. What was salaries expense for the year

Salaries payable increased by $6,000 during the year, so salaries expense must be $156,000 ($150,000 in cash paid plus the increase in salaries payable). Salaries payable of $18,000 is reported as a liability in an accrual basis balance sheet. Using T-accounts is a convenient approach for converting from cash to accrual accounting.

The debit to salaries expense and credit to salaries payable must have been $156,000 to balance the salaries payable account.For another example using T-accounts, assume that the amount of cash collected from customers during the year was $220,000, and you know that accounts receivable at the beginning of the year was $45,000 and $33,000 at the end of the year. You can use T-accounts to determine that sales revenue for the year must have been $208,000, the necessary debit to accounts receivable and credit to sales revenue to balance the accounts receivable account

Now suppose that, on occasion, customers pay in advance of receiving a product or service. Recall from our previous discussion of adjusting entries that this event creates a liability called unearned revenue. Assume the same facts in the previous example except you also determine that unearned revenues were $10,000 and $7,000 at the beginning and end of the year, respectively. A $3,000 decrease in unearned revenues means that the company earned an additional $3,000 in sales revenue for which the cash had been collected in a previous year. So, sales revenue for the year must have been $211,000, the $208,000 determined in the previous example plus the $3,000 decrease in unearned revenue.

Notice a pattern in the adjustments to cash net income. When converting from cash to accrual income, we add increases and deduct decreases in assets. For example, an increase in accounts receivable means that the company earned more revenue than cash collected, requiring the addition to cash basis income. Conversely, we add decreases and deduct increases in accrued liabilities. For example, a decrease in interest payable means that the company incurred less interest expense than the cash interest it paid, requiring the addition to cash basis income.

No comments:

Post a Comment