Costs and Cost Terminology

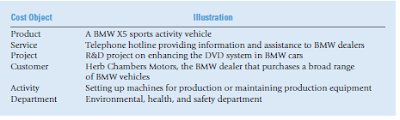

Accountants define cost as a resource sacrificed or forgone to achieve a specific objective. A cost (such as direct materials or advertising) is usually measured as the monetary amount that must be paid to acquire goods or services. An actual cost is the cost incurred (a historical or past cost), as distinguished from a budgeted cost, which is a predicted orforecasted cost (a future cost). When you think of cost, you invariably think of it in the context of finding the cost of a particular thing. We call this thing a cost object, which is anything for which a measurement of costs is desired. Suppose that you were a manager at BMW’s Spartanburg, South Carolina, plant. BMW makes several different types of cars and sport activity vehicles (SAVs) at this plant. What cost objects can you think of? Now look at Exhibit 2-1. You will see that BMW managers not only want to know the cost of various products, such as the BMW X5, but they also want to know the costs of things such as projects,

Accountants define cost as a resource sacrificed or forgone to achieve a specific objective. A cost (such as direct materials or advertising) is usually measured as the monetary amount that must be paid to acquire goods or services. An actual cost is the cost incurred (a historical or past cost), as distinguished from a budgeted cost, which is a predicted orforecasted cost (a future cost). When you think of cost, you invariably think of it in the context of finding the cost of a particular thing. We call this thing a cost object, which is anything for which a measurement of costs is desired. Suppose that you were a manager at BMW’s Spartanburg, South Carolina, plant. BMW makes several different types of cars and sport activity vehicles (SAVs) at this plant. What cost objects can you think of? Now look at Exhibit 2-1. You will see that BMW managers not only want to know the cost of various products, such as the BMW X5, but they also want to know the costs of things such as projects,

|

| Exhibit 2-1 |

services, and departments. Managers use their knowledge of these costs to guide decisions about, for example, product innovation, quality, and customer service. Now think about whether a manager at BMW might want to know the budgeted cost of a cost object, or the actual cost. Managers almost always need to know both types of costs when making decisions. For example, comparing budgeted costs to actual costs helps managers evaluate how well they did and learn about how they can do better in the future

How does a cost system determine the costs of various cost objects? Typically in two basic stages: accumulation, followed by assignment. Cost accumulation is the collection of cost data in some organized way by means of an accounting system. For example, at its Spartanburg plant, BMW collects (accumulates) costs in various categories such as different types of materials, different classifications of labor, and costs incurred for supervision. Managers and management accountants then assign these accumulated costs to designated cost objects, such as the different models of cars that BMW manufactures at the plant. BMW managers use this cost information in two main ways

1. when making decisions, for instance, on how to price different models of cars or\ how much to invest

How does a cost system determine the costs of various cost objects? Typically in two basic stages: accumulation, followed by assignment. Cost accumulation is the collection of cost data in some organized way by means of an accounting system. For example, at its Spartanburg plant, BMW collects (accumulates) costs in various categories such as different types of materials, different classifications of labor, and costs incurred for supervision. Managers and management accountants then assign these accumulated costs to designated cost objects, such as the different models of cars that BMW manufactures at the plant. BMW managers use this cost information in two main ways

1. when making decisions, for instance, on how to price different models of cars or\ how much to invest

in R&D and marketing and

2. for implementing decisions, by influencing and motivating employees to act and learn, for example, by rewarding employees for reducing costs. Now that we know why it is useful to assign costs, we turn our attention to some concepts that will help us do it. Again, think of the different types of costs that we just discussed—materials, labor, and supervision. You are probably thinking that some costs, such as costs of materials, are easier to assign to a cost object than others, such as costs of supervision. As you will see, this is indeed the case.

Direct Costs and Indirect Costs

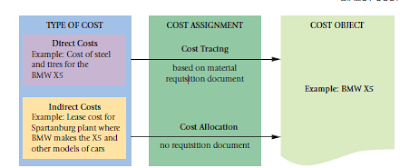

We now describe how costs are classified as direct and indirect costs and the methods used to assign these costs to cost objects. Direct costs of a cost object are related to the particular cost object and can be traced to it in an economically feasible (cost-effective) way. For example, the cost of steel or tires is a direct cost of BMW X5s. The cost of the steel or tires can be easily traced to or identified with the BMW X5. The workers on the BMW X5 line request materials from the warehouse and the material requisition document identifies the cost of the materials supplied to the X5. In a similar vein, individual workers record the time spent working on the X5 on time sheets. The cost of this labor can easily be traced to the X5 and is another example of a direct cost. The term cost tracing is used to describe the assignment of direct costs to a particular cost object.

Indirect costs of a cost object are related to the particular cost object but cannot be traced to it in an economically feasible (cost-effective) way. For example, the salaries of plant administrators (including the plant manager) who oversee production of the many different types of cars produced at the Spartanburg plant are an indirect cost of the X5s. Plant administration costs are related to the cost object (X5s) because plant administration is necessary for managing the production of X5s. Plant administration costs are indirect costs because plant administrators also oversee the production of other

Direct Costs and Indirect Costs

We now describe how costs are classified as direct and indirect costs and the methods used to assign these costs to cost objects. Direct costs of a cost object are related to the particular cost object and can be traced to it in an economically feasible (cost-effective) way. For example, the cost of steel or tires is a direct cost of BMW X5s. The cost of the steel or tires can be easily traced to or identified with the BMW X5. The workers on the BMW X5 line request materials from the warehouse and the material requisition document identifies the cost of the materials supplied to the X5. In a similar vein, individual workers record the time spent working on the X5 on time sheets. The cost of this labor can easily be traced to the X5 and is another example of a direct cost. The term cost tracing is used to describe the assignment of direct costs to a particular cost object.

Indirect costs of a cost object are related to the particular cost object but cannot be traced to it in an economically feasible (cost-effective) way. For example, the salaries of plant administrators (including the plant manager) who oversee production of the many different types of cars produced at the Spartanburg plant are an indirect cost of the X5s. Plant administration costs are related to the cost object (X5s) because plant administration is necessary for managing the production of X5s. Plant administration costs are indirect costs because plant administrators also oversee the production of other

|

| Exhibit 2-2 |

products, such as the Z4 Roadster. Unlike the cost of steel or tires, there is no requisition of plant administration services and it is virtually impossible to trace plant administration costs to the X5 line. The term cost allocation is used to describe the assignment of indirect costs to a particular cost object. Cost assignment is a general term that encompasses both (1) tracing direct costs to a cost object and (2) allocating indirect costs to a cost object. Exhibit 2-2 depicts direct costs and indirect costs and both forms of costassignment cost tracing and cost allocation using the example of the BMW X5.

Challenges in Cost Allocation

Consider the cost to lease the Spartanburg plant. This cost is an indirect cost of the X5 there is no separate lease agreement for the area of the plant where the X5 is made. But BMW allocates to the X5 a part of the lease cost of the building for example, on the basis of an estimate of the percentage of the building’s floor space occupied for the production of the X5 relative to the total floor space used to produce all models of cars. Managers want to assign costs accurately to cost objects. Inaccurate product costs will mislead managers about the profitability of different products and could cause managers to unknowingly promote unprofitable products while deemphasizing profitable products. Generally, managers are more confident about the accuracy of direct costs of cost objects, such as the cost of steel and tires of the X5.

Identifying indirect costs of cost objects, on the other hand, can be more challenging. Consider the lease. An intuitive method is to allocate lease costs on the basis of the total floor space occupied by each car model. This approach measures the building resources used by each car model reasonably and accurately. The more floor space that a car model occupies, the greater the lease costs assigned to it. Accurately allocating other indirect costs, such as plant administration to the X5, however, is more difficult. For example, should these costs be allocated on the basis of the number of workers working on each car model or the number of cars produced of each model? How to measure the share of plant administration used by each car model is not clear-cut.

Factors Affecting Direct/Indirect Cost Classifications

Several factors affect the classification of a cost as direct or indirect:

Challenges in Cost Allocation

Consider the cost to lease the Spartanburg plant. This cost is an indirect cost of the X5 there is no separate lease agreement for the area of the plant where the X5 is made. But BMW allocates to the X5 a part of the lease cost of the building for example, on the basis of an estimate of the percentage of the building’s floor space occupied for the production of the X5 relative to the total floor space used to produce all models of cars. Managers want to assign costs accurately to cost objects. Inaccurate product costs will mislead managers about the profitability of different products and could cause managers to unknowingly promote unprofitable products while deemphasizing profitable products. Generally, managers are more confident about the accuracy of direct costs of cost objects, such as the cost of steel and tires of the X5.

Identifying indirect costs of cost objects, on the other hand, can be more challenging. Consider the lease. An intuitive method is to allocate lease costs on the basis of the total floor space occupied by each car model. This approach measures the building resources used by each car model reasonably and accurately. The more floor space that a car model occupies, the greater the lease costs assigned to it. Accurately allocating other indirect costs, such as plant administration to the X5, however, is more difficult. For example, should these costs be allocated on the basis of the number of workers working on each car model or the number of cars produced of each model? How to measure the share of plant administration used by each car model is not clear-cut.

Factors Affecting Direct/Indirect Cost Classifications

Several factors affect the classification of a cost as direct or indirect:

The materiality of the cost in question.

The smaller the amount of a cost—that is, the more immaterial the cost is the less likely that it is economically feasible to trace that cost to a particular cost object. Consider a mail-order catalog company such as Lands’ End. It would be economically feasible to trace the courier charge for delivering a package to an individual customer as a direct cost. In contrast, the cost of the invoice paper included in the package would be classified as an indirect cost. Why? Although the cost of the paper can be traced to each customer, it is not cost-effective to do so. The benefits of knowing that, say, exactly 0.5¢ worth of paper is included in each package do not exceed the data processing and administrative costs of tracing the cost to each package. The time of the sales administrator, who earns a salary of $45,000 a year, is better spent organizing customer information to assist in focused marketing efforts than on tracking the cost of paper.

Available information-gathering technology.

Available information-gathering technology.

Improvements in information-gathering technology make it possible to consider more and more costs as direct costs. Bar codes, for example, allow manufacturing plants to treat certain low-cost materials such as clips and screws, which were previously classified as indirect costs, as direct costs of products. At Dell, component parts such as the computer chip and the CD-ROM drive display a bar code that can be scanned at every point in the production process. Bar codes can be read into a manufacturing cost file by waving a “wand” in the same quick and efficient way supermarket checkout clerks enter the cost of each item purchased by a customer

Design of operations.

Design of operations.

Classifying a cost as direct is easier if a company’s facility (or some part of it) is used exclusively for a specific cost object, such as a specific product or a particular customer. For example, the cost of the General Chemicals facility dedicated to manufacturing soda ash is a direct cost of soda ash.

Be aware that a specific cost may be both a direct cost of one cost object and an indirect cost of another cost object. That is, the direct/indirect classification depends on the choice of the cost object. For example, the salary of an assembly department supervisor at BMW is a direct cost if the cost object is the assembly department, but it is an indirect cost if the cost object is a product such as the BMW X5 SAV, because the assembly department assembles many different models. A useful rule to remember is that the broader the definition of the cost object—the assembly department rather than the X5 SAV the higher the proportion of total costs that are direct costs and the more confidence a manager has in the accuracy of the resulting cost amounts.

Be aware that a specific cost may be both a direct cost of one cost object and an indirect cost of another cost object. That is, the direct/indirect classification depends on the choice of the cost object. For example, the salary of an assembly department supervisor at BMW is a direct cost if the cost object is the assembly department, but it is an indirect cost if the cost object is a product such as the BMW X5 SAV, because the assembly department assembles many different models. A useful rule to remember is that the broader the definition of the cost object—the assembly department rather than the X5 SAV the higher the proportion of total costs that are direct costs and the more confidence a manager has in the accuracy of the resulting cost amounts.

No comments:

Post a Comment