Sometimes, companies issue debt that can be converted into equity shares at maturity. Such debt is called convertible debt. Convertible debt is the classic hybrid security as it is a combination of features of both debt and equity. Usually, convertible debt allows the holder an option to convert at a fixed price. Therefore, conversion will occur only if the share price is higher than the conversion price at maturity. If it is not, the debt holders can ask for repayment of principal.

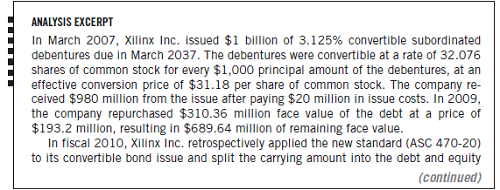

Current accounting rules under both US GAAP (ASC 470-20) and IFRS (IAS 32) recognize the mixed nature of convertible debt. Specifically, companies issuing convertible debt must separately account for the liability (debt) and equity (conversion option) components on the date of the issue. The amount allocated to the liability is estimated by determining the fair value of a pure debt security that is similar in every other respect to the convertible security. Once the liability amount is estimated, the amount allocated to equity is simply the residual value of the convertible security.

We clarify with an example. Consider a company that issues 1 million 10-year convertible bonds with a face value of $100 and a coupon rate of 3%. Each bond allows theholder to purchase four shares of the company at maturity. A pure bond with a similar maturity and risk profile is expected to have an effective interest rate of 8%. The proceeds from this issue amounted to $105 million. To estimate the value of the equity and the debt components, we first need to determine the value of the pure bond with a similar maturity and coupon. Note the coupon payment per bond is $3 per year and maturity is 10 years. Given an effective interest rate of 8%, the present value of this bond is $66.45. Therefore, the amount allocated to the liability will be $66.45 million, and the discount on the bond issue will amount to $33.55 million ($100 million $66.45 million). This discount is amortized over the bond’s term in a similar manner as illustrated in Exhibit 3.1. Since the proceeds from the bond issue come to $105 million, the premium of $38.55 million ($105 million $66.45 million) is attributable to the equity component, assuming no deferred tax effects.

We clarify with an example. Consider a company that issues 1 million 10-year convertible bonds with a face value of $100 and a coupon rate of 3%. Each bond allows theholder to purchase four shares of the company at maturity. A pure bond with a similar maturity and risk profile is expected to have an effective interest rate of 8%. The proceeds from this issue amounted to $105 million. To estimate the value of the equity and the debt components, we first need to determine the value of the pure bond with a similar maturity and coupon. Note the coupon payment per bond is $3 per year and maturity is 10 years. Given an effective interest rate of 8%, the present value of this bond is $66.45. Therefore, the amount allocated to the liability will be $66.45 million, and the discount on the bond issue will amount to $33.55 million ($100 million $66.45 million). This discount is amortized over the bond’s term in a similar manner as illustrated in Exhibit 3.1. Since the proceeds from the bond issue come to $105 million, the premium of $38.55 million ($105 million $66.45 million) is attributable to the equity component, assuming no deferred tax effects.

Companies sometimes issue bonds with attached warrants on the company’s equity. Warrants entitle the holder to buy the underlying stock of the issuer at a fixed exercise price until the expiration date, similar to a call option. This is different from convertible debt because the bonds and the warrants are separate securities, and the holder can sell the warrants or the debt separately. The accounting treatment for warrants is similar t that for convertible bonds. That is, the bonds are accounted for as debt and the warrants as equity at their respective fair values on the date of issue.

Redeemable Preferred Stock

Analysts must be alert for equity securities (typically preferred stock) that possess mandatory redemption provisions making them more akin to debt than equity. These securities require a company to pay funds at specific dates. A true equity security does not impose such requirements. Examples of these securities, under the guise of preferred stock, exist for many companies. Tenneco’s annual report refers to its preferred stock redemption provision as follows:

Redeemable Preferred Stock

Analysts must be alert for equity securities (typically preferred stock) that possess mandatory redemption provisions making them more akin to debt than equity. These securities require a company to pay funds at specific dates. A true equity security does not impose such requirements. Examples of these securities, under the guise of preferred stock, exist for many companies. Tenneco’s annual report refers to its preferred stock redemption provision as follows:

The SEC asserts that redeemable preferred stocks are different from conventional equity capital and should not be included in shareholders’ equity nor combined with nonredeemable equity securities. The SEC also requires disclosure of redemption terms and five-year maturity data. Accounting standards require disclosure of redemption requirements of redeemable stock for each of the five years subsequent to the balance sheet date. Companies whose shares are not publicly traded are not subject to SEC requirements and can continue to report redeemable preferred stock as equity. Still, our analysis should treat them for what they are an obligation to pay cash at a future date.

Minority Interest

A company may own a controlling share (usually more than 50%), but not all, of the equity of another company. The company that owns the controlling share is called a parent and the company that is thus owned a partially owned subsidiary. Minority interest (also called noncontrolling interest ) refers to the portion of the partially owned subsidiary’s shareholders’ equity that belongs to the minority (outside) shareholders. It is truly an intermediate capital form. Because it does not belong to the parent company’s shareholders, it cannot be regarded as part of the parent company’s shareholders’ equity. However, even though it belongs to outsiders, it is in the nature of shareholders’ equity and therefore cannot also be classified as a liability.

Parent companies are required to consolidate the subsidiary’s financial statements in their own. In the consolidated statements, the assets and liabilities (and the revenues and expenses) of the subsidiary are aggregated with that of the parent. When the subsidiary is partially owned, shareholders’ equity cannot be aggregated, because the entire subsidiary’s equity does not belong to the parent. Accordingly, US GAAP and IFRS require companies to report minority interest in the consolidated balance sheet as a separate line item that is not part of parent shareholders’ equity. However, most companies do report minority interest as part of total equity. In a similar manner, the proportion of the net income of a partially owned subsidiary that belongs to the minority shareholders is shown in the consolidated income statement as a separate line item called minority interest (or noncontrolling interest ). Exhibit 3.14 presents an example of how minority (noncontrolling) interest is reported both in the balance sheet and the income statement.

Minority Interest

A company may own a controlling share (usually more than 50%), but not all, of the equity of another company. The company that owns the controlling share is called a parent and the company that is thus owned a partially owned subsidiary. Minority interest (also called noncontrolling interest ) refers to the portion of the partially owned subsidiary’s shareholders’ equity that belongs to the minority (outside) shareholders. It is truly an intermediate capital form. Because it does not belong to the parent company’s shareholders, it cannot be regarded as part of the parent company’s shareholders’ equity. However, even though it belongs to outsiders, it is in the nature of shareholders’ equity and therefore cannot also be classified as a liability.

Parent companies are required to consolidate the subsidiary’s financial statements in their own. In the consolidated statements, the assets and liabilities (and the revenues and expenses) of the subsidiary are aggregated with that of the parent. When the subsidiary is partially owned, shareholders’ equity cannot be aggregated, because the entire subsidiary’s equity does not belong to the parent. Accordingly, US GAAP and IFRS require companies to report minority interest in the consolidated balance sheet as a separate line item that is not part of parent shareholders’ equity. However, most companies do report minority interest as part of total equity. In a similar manner, the proportion of the net income of a partially owned subsidiary that belongs to the minority shareholders is shown in the consolidated income statement as a separate line item called minority interest (or noncontrolling interest ). Exhibit 3.14 presents an example of how minority (noncontrolling) interest is reported both in the balance sheet and the income statement.

Whether one needs to include or exclude minority interest depends on the analysis objective. For example, if we wish to determine the ROCE of the shareholders of a company, we must exclude minority interest both in the numerator (income) and denominator (equity) of the ratio. But if the objective is to compute the ROCE of the combined business entities that comprise a company, then we should include minority interest in the computation. In the example in Exhibit 3.14, ROCE of the Bristol-Myers Squibb shareholders is 23% ($3,709 $15,956), but ROCE of the combined businesses of Bristol-Myers Squibb and its subsidiaries is 33% ($5,260 $15,867).

No comments:

Post a Comment