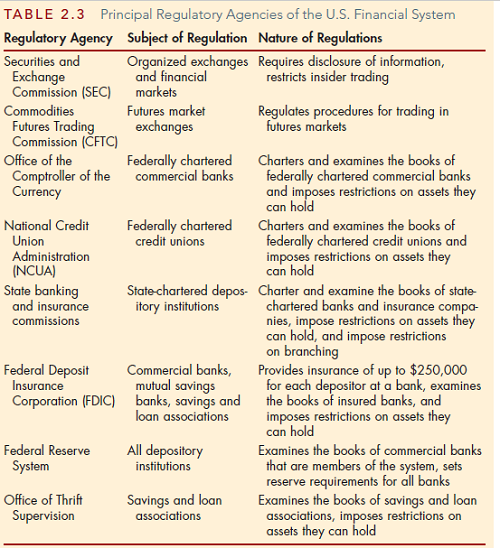

The financial system is among the most heavily regulated sectors of the American economy. The government regulates financial markets for two main reasons: to increase the information available to investors and to ensure the soundness of the financial system. We will examine how these two reasons have led to the present regulatory environment. As a study aid, the principal regulatory agencies of the U.S. financial system are listed in Table 2.3.

Increasing Information Available to Investors

Asymmetric information in financial markets means that investors may be subject to adverse selection and moral hazard problems that may hinder the efficient operation of financial markets. Risky firms or outright crooks may be the most eager to sell securities to unwary investors, and the resulting adverse selection problem may keep investors out of financial markets. Furthermore, once an investor has bought a security, thereby lending money to a firm, the borrower may have incentives to engage

Increasing Information Available to Investors

Asymmetric information in financial markets means that investors may be subject to adverse selection and moral hazard problems that may hinder the efficient operation of financial markets. Risky firms or outright crooks may be the most eager to sell securities to unwary investors, and the resulting adverse selection problem may keep investors out of financial markets. Furthermore, once an investor has bought a security, thereby lending money to a firm, the borrower may have incentives to engage

in risky activities or to commit outright fraud. The presence of this moral hazard problem may also keep investors away from financial markets. Government regulation can reduce adverse selection and moral hazard problems in financial markets and increase their efficiency by increasing the amount of information available to investors. As a result of the stock market crash in 1929 and revelations of widespread fraud in the aftermath, political demands for regulation culminated in the Securities Act of 1933 and the establishment of the Securities and Exchange Commission (SEC). The SEC requires corporations issuing securities to disclose certain information about their sales, assets, and earnings to the public and restricts trading by the largest stockholders (known as insiders) in the corporation. By requiring disclosure of this information and by discouraging insider trading, which could be used to manipulate security prices, the SEC hopes that investors will be better informed and protected from some of the abuses in financial markets that occurred before 1933. Indeed, in recent years, the SEC has been particularly active in prosecuting people involved in insider trading.

No comments:

Post a Comment